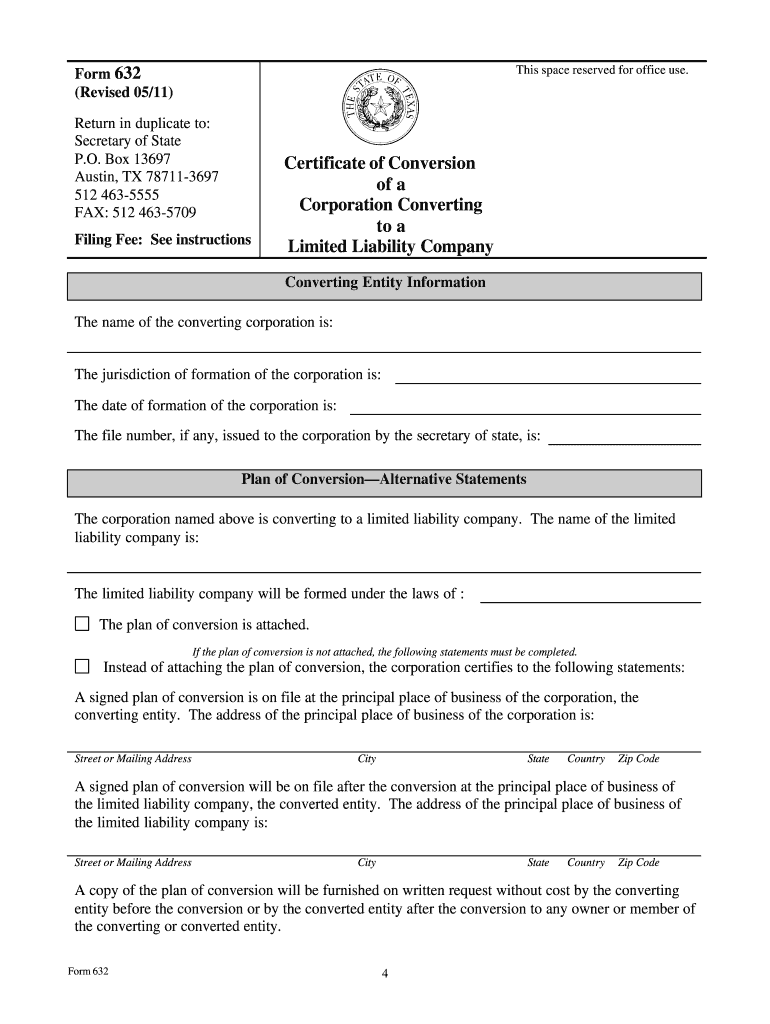

TX Form 632 2011-2025 free printable template

Get, Create, Make and Sign texas conversion form

How to edit texas certificate llc online

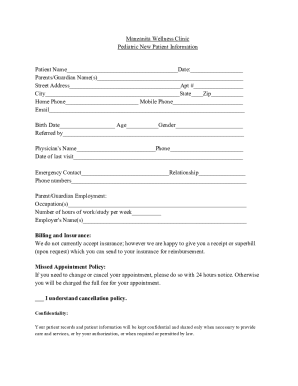

How to fill out conversion converting liability form

How to fill out TX Form 632

Who needs TX Form 632?

Video instructions and help with filling out and completing texas conversion corporation

Instructions and Help about texas conversion sample

Alright guys just another rendition of your hole-in-the-wall messy miracle bench non Brooklyn CB shop your man pistol at the helm of this row okay guys here we have a brand spanking new Texas star DX 1600 man out the box alright never you never hooked up, yet now you know we know these things don't come plug-and-play man we have to do what text — right well here we go I'm going to try to look up some information in this box, and you're going to find this on a one of your local model websites, and it's telling you downside of the green wire the oscillator board from the orange wire already done okay it's telling you to remove the black wire from the key-in jack already done okay it's telling you to remove the isolator board done we moved to 33 picofarad cabins parallel to 15 we compared a cat next to the small wheel a done we moved the purple wire attached to the rods relaying discard one purple wire there is no purple wire right away okay I'm going to take this Auto negative 220 mm 200k captain Bob's really with a purple wire was, but there's no part with why I walk out there that's going to tell you we move the two 330 feet Köpenick caps and series and connector and lost her right not dad already removed as you think it saw the orange wire to the center of the coax connect and walk the radio already done so now guys you know you want this box to plug and play man well check it out this information is outdated okay the new box is coming off to wine I like relatively simple for example when you come right one of these new RMS man all you got to do is uh jump to leads together right well in the Texas stuff how it goes today is relatively simple it's one maneuver simple and what it is I'm not gonna lie to you let me get over here as you can see I'm giving you an illustration a little clearer here because I can see you can see it on the screen better so what we're doing is we are connecting the fifteenth peak of Prairie cap we move it in from that foil and moving it to that foil if you do not understand what I just said, or you do not understand how this conversion is done and this conversion is white flannels to you all my impose in the contacts actually thank you

People Also Ask about texas conversion llc form

What annual filings are required for a Texas LLC?

How do I start a limited liability corporation in Texas?

What forms do I need to start a LLC in Texas?

What is a limited liability corporation in Texas?

How to file form 304 in Texas?

What forms are needed for Texas LLC?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my texas conversion llc in Gmail?

How do I edit certificate conversion form fill straight from my smartphone?

Can I edit texas converting on an Android device?

What is TX Form 632?

Who is required to file TX Form 632?

How to fill out TX Form 632?

What is the purpose of TX Form 632?

What information must be reported on TX Form 632?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.